FOR A MODERN FINTECH ARCHITECTURE

Thrive at your core.

We orchestrate the rest.

BKN301 is a Financial Operating System and provider committed to empowering the financial industry with innovative, scalable solutions.

FOR A MODERN FINTECH ARCHITECTURE

Thrive at your core.

We orchestrate the rest.

BKN301 is a Financial Operating System and provider committed to empowering the financial industry with innovative, scalable solutions.

Recognized as a leading player in the evolving fintech landscape.

We support the shift towards intelligent, efficient financial operations with secure and scalable payment capabilities.

Discover MoreBKN301 ORCHESTRATOR

BKN301 ORCHESTRATOR

BKN301 ORCHESTRATOR

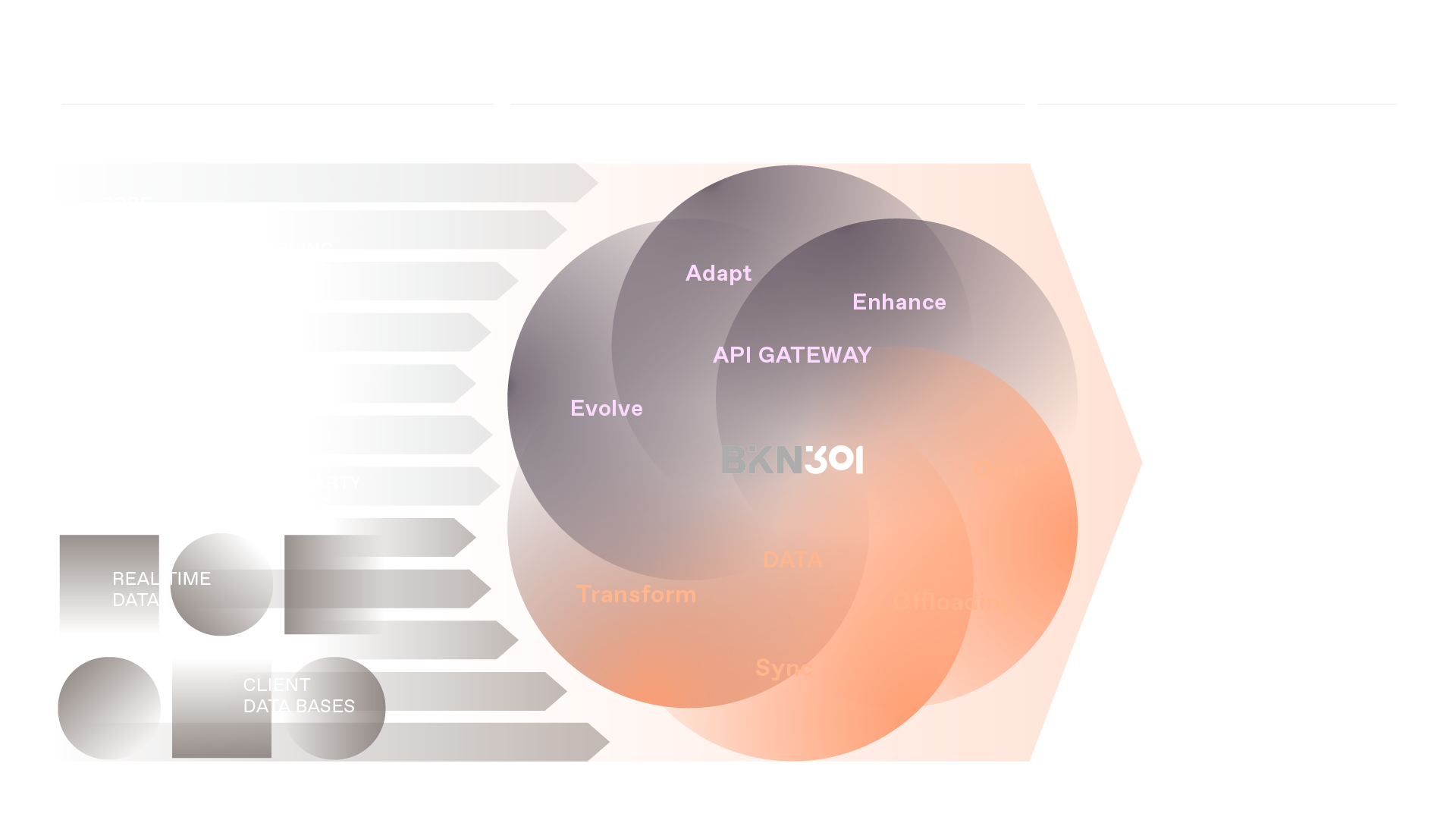

A Smarter Way to Build Finance

A Smarter Way to Build Finance

Through one unified API layer, we bring together core banking, open banking, payment processing, AI and GenAI while seamlessly integrating with third-party systems.

The Data Decoupling Layer ensures standardized data, clean analytics and an AI-ready data foundation.

Through one unified API layer, we bring together core banking, open banking, payment processing, AI and GenAI while seamlessly integrating with third-party systems.

The Data Decoupling Layer ensures standardized data, clean analytics and an AI-ready data foundation.

BKN301 PLATFORM

BKN301 PLATFORM

How Our Orchestrator Makes It Possible

How Our Orchestrator Makes It Possible

BKN301 Orchestrator replaces the limitations of traditional ESB architectures with a modern, scalable, and cloud-native model.

NEXT-GEN FINTECH PROVIDER

NEXT-GEN FINTECH PROVIDER

Enabling secure, efficient, and scalable digital finance

Enabling secure, efficient, and scalable digital finance

The Challenge

Legacy infrastructures have become costly, slow to adapt, and difficult to scale. Every new integration adds compliance burdens, operational overhead, and integration risks. This complexity holds back innovation and market expansion.

Our Solution

BKN301 orchestrates everything through one secure and compliant hub. The result is efficiency, scalability, compliance, customization.

The Outcome

Stay focused on your core business while new services launch and scale seamlessly. Unlock new revenue streams through smooth integrations and expand into new markets without legacy barriers. Lower total cost of ownership with efficient, flexible orchestration.

The Challenge

Legacy infrastructures have become costly, slow to adapt, and difficult to scale. Every new integration adds compliance burdens, operational overhead, and integration risks. This complexity holds back innovation and market expansion.

Our Solution

BKN301 orchestrates everything through one secure and compliant hub. The result is efficiency, scalability, compliance, customization.

The Outcome

Stay focused on your core business while new services launch and scale seamlessly. Unlock new revenue streams through smooth integrations and expand into new markets without legacy barriers. Lower total cost of ownership with efficient, flexible orchestration.

BKN301 Orchestrator

BKN301 Orchestrator

A modular platform for control, compliance, and growth.

We remove the barriers of fragmentation, legacy systems, and regulatory hurdles so financial innovators can focus on launching products, expanding into new markets, and creating value for their customers

Core-Banking

and Open Banking

Payments and Payment Processing

AI and GenAI

External Third-Party

Services

Core-Banking

and Open Banking

Payments and Payment Processing

AI and GenAI

External Third-Party

Services

What Makes Us Different

Safeguard trust with secure operations thanks to transparent data ownership and DDL

Independent and unbiased, giving you the freedom to choose the best partners for your business

Technologists, engineers, and industry experts working together

From design to operations, across legacy and digital

Global deployments delivered at speed

From design to operations, across legacy and digital

Fast, adaptable, and innovation-driven

Let’s build a secure, innovative financial future, together.

TRUSTED BY

Main brands in partnership with BKN301 Group companies