Last week, the fintech landscape in the Gulf was energized during Web Summit Qatar in Doha, where Enea Stucchi, Head of Growth at BKN301, reflected on the data behind this accelerating momentum.

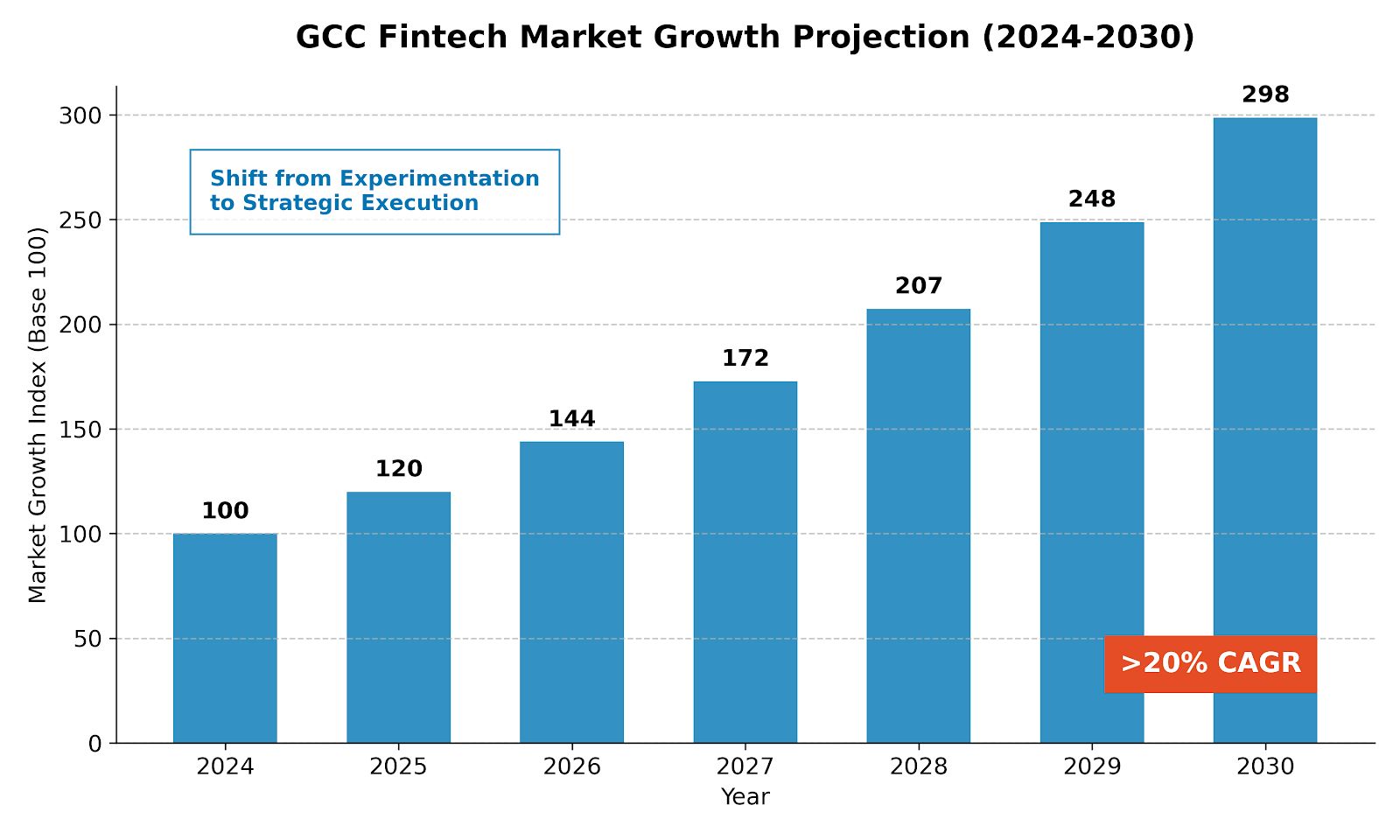

The GCC fintech market is expanding rapidly, projected to grow from QAR 5.6 billion in 2023 to an estimated QAR 31.7 billion by 2030, reflecting an annual growth rate of around 25%. Digital payments and peer-to-peer (P2P) lending are leading this transformation, driving structural change across the region’s financial services ecosystem.

A Closer Look at Qatar’s Fintech Ecosystem

Focusing on Qatar, the evolution is especially visible.

National strategies and proactive regulators are significantly strengthening Qatar’s fintech ecosystem, positioning the country as a regional hub for innovation and financial inclusion. Regulatory clarity and institutional support are creating the right conditions for sustainable fintech growth.

At the same time, digital adoption is no longer theoretical. Consumers and businesses are increasingly using:

-

Digital wallets

-

Open APIs

-

New-generation payment systems

These technologies are reshaping cross-border transactions and inter-industry money movement, accelerating the country’s digital transformation.

Initiatives such as Qatar FinTech Hub (QFTH) are turning innovative ideas into tangible services by offering mentorship, funding, and talent development programs for early-stage fintech startups. This ecosystem approach is helping bridge the gap between innovation and real-world application.

From Experimentation to Operational Effectiveness

Another clear takeaway from Web Summit Qatar is how the conversation has evolved.

Fintech discussions in the GCC are moving beyond experimentation and idea-sharing. The emphasis is now on operational effectiveness: building robust financial infrastructure, clarifying regulatory frameworks, and ensuring seamless system integration.

This is where genuine progress is made.

Fintech is not only about launching new products. The real challenge lies in developing solutions that are resilient, adaptable, and scalable across multiple markets. Many institutions can successfully run pilot projects, but transitioning from pilot to full-scale production remains complex — particularly when integration with diverse systems and partners is required.

Scalability and interoperability are becoming the true differentiators.

Conversations That Go Beyond the Hype

It was encouraging to see these themes repeatedly surface in Doha. Teams from BKN301 were at Web Summit Qatar engaging with financial institutions and partners around these execution challenges.

The focus of those conversations was not on short-term excitement, but on the strategic decisions that support long-term growth. The priority was clear: build infrastructure that works, ensure regulatory alignment, and create systems that function cohesively across markets.

What resonated most was not just the technology itself, but the shared commitment to delivering real results — building effective financial systems that can sustain the next phase of GCC fintech growth.