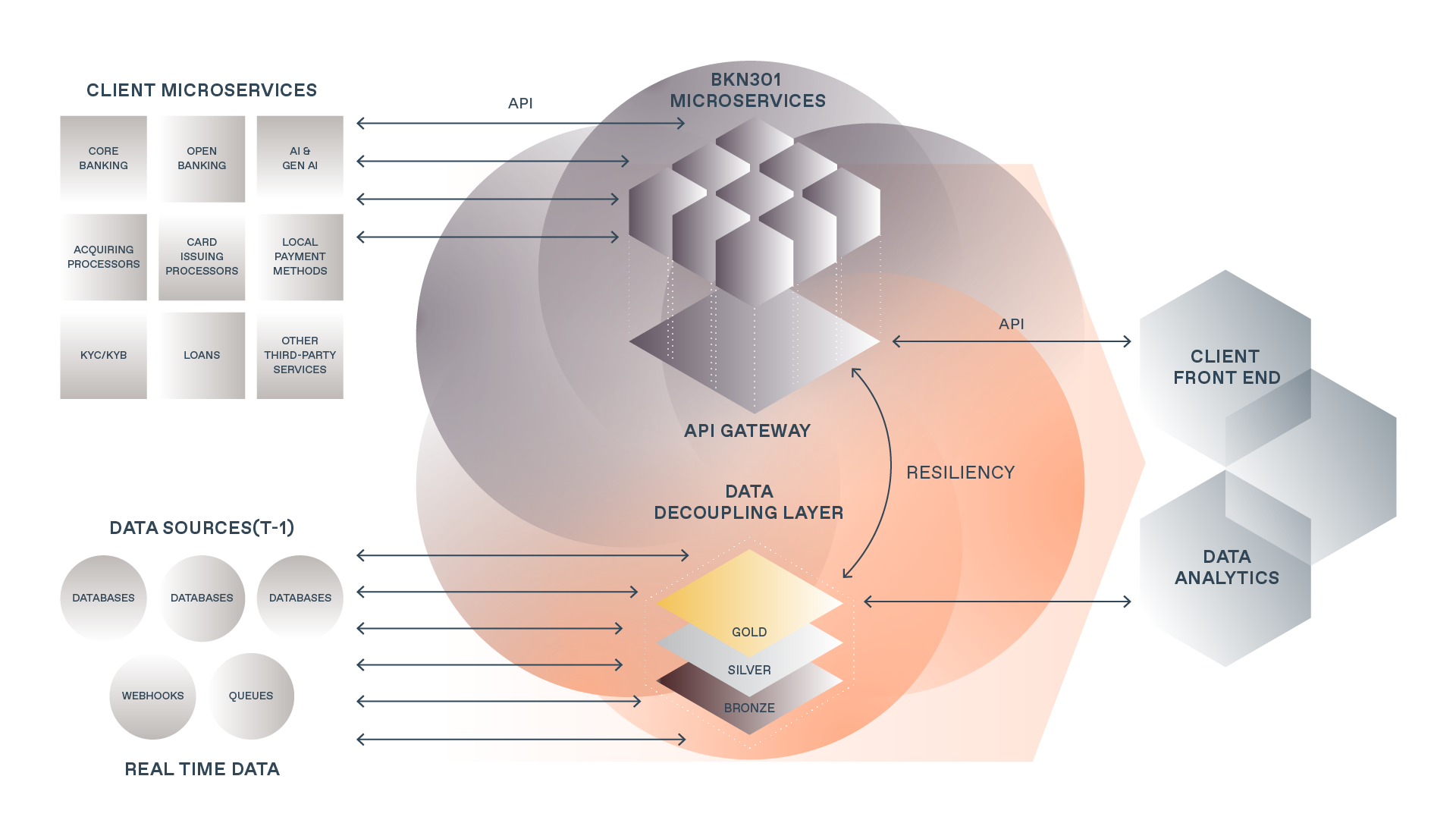

BKN301 Orchestrator

Thrive at your core. We orchestrate the rest.

Through one unified API layer, we bring together core banking, open banking, payment processing, AI and GenAI while seamlessly integrating with third-party systems.

The Data Decoupling Layer ensures standardized data, clean analytics and an AI-ready data foundation.

THE PLATFORM

How Our Orchestrator Works

API-driven by design, it enables faster integrations, seamless connectivity, and real-time orchestration across systems and partners.

Platform Capabilities

Choose the services you need and expand as you grow. Each module is independent yet fully connected, so you can configure the platform to match your strategy.

A normalized data layer (DDL) ensures information is consistent and structured across all systems — enabling clean analytics, smooth migrations, and reliable operations.

Fit seamlessly into your existing architecture and easily connect with third-party providers. The platform adapts to your needs, not the other way around.

One interface gives access to the entire financial ecosystem, reducing integration time and accelerating product launches.

Grow across borders and scale business volumes with confidence. The Orchestrator evolves with your ambitions.

Stay ahead of changing requirements with built-in licenses, continuous monitoring, and trusted compliance partners.

Why it matters

With BKN301, banks, fintechs, and digital platforms gain freedom to innovate without disruption, reduce costs while accelerating delivery, and scale their offerings with confidence. Modularity gives choice, flexibility ensures adaptability, and orchestration keeps everything connected.

Faster time-to-market

in months, not years

Operational saving

Replace heavy infrastructure investments with a Contract-as-

a-Service model

Greater efficiency

cut manual work and lower risks

Future-ready growth

scales globally while staying compliant

Faster time-to-market

in months, not years

Operational saving

Replace heavy infrastructure investments with a Contract-as-

a-Service model

Greater efficiency

cut manual work and lower risks

Future-ready growth

scales globally while staying compliant

A modular platform for control, compliance, and growth

We remove the barriers of fragmentation, legacy systems, and regulatory hurdles so financial innovators can focus on launching products, expanding into new markets, and creating value for their customers

Core-Banking and Open Banking

Orchestrate multiple core-banking solutions and enable open banking capabilities, including data aggregation. Improve efficiency, compliance, and innovation while accelerating time-to-market.

Payments and Payment Processing

Enable card issuing (physical or virtual), acquiring, wallets, and account-to-account transfers for both e-commerce and in-store transactions.

AI & GenAI

Automate processes, power analytics, and deliver personalized experiences with advanced AI and GenAI solutions.

External Third-Party Services

Integrate seamlessly with your legacy systems and fintech partners, extending capabilities without any lock-in.